THE current iteration of the drawn out, cost-inflated but generationally significant Metronet rail project will enter its final stages in the next year or two.

The price tag attached to the signature policy of Deputy Premier, Transport Minister and Treasurer Rita Saffioti has swelled over years, but its necessity in a sprawl-happy city like Perth is evident to even the policy’s harshest critics.

Metronet’s cost challenges are well known. A policy originally costing $2.9 billion has grown to $12.6 billion, though as Ms Saffioti pointed out in her first post-budget speaking appearance, the number of projects delivered under the Metronet banner has also grown with time.

By the treasurer’s reckoning, the original nine Metronet projects promised at the 2017 election have grown to cost of $6.6 billion, due to the effects of the labour squeeze, supply shortages and delays resulting from the pandemic.

Meanwhile, the pipeline of public infrastructure spending in the years ahead is starting to become clear, and transport projects no longer top the tree.

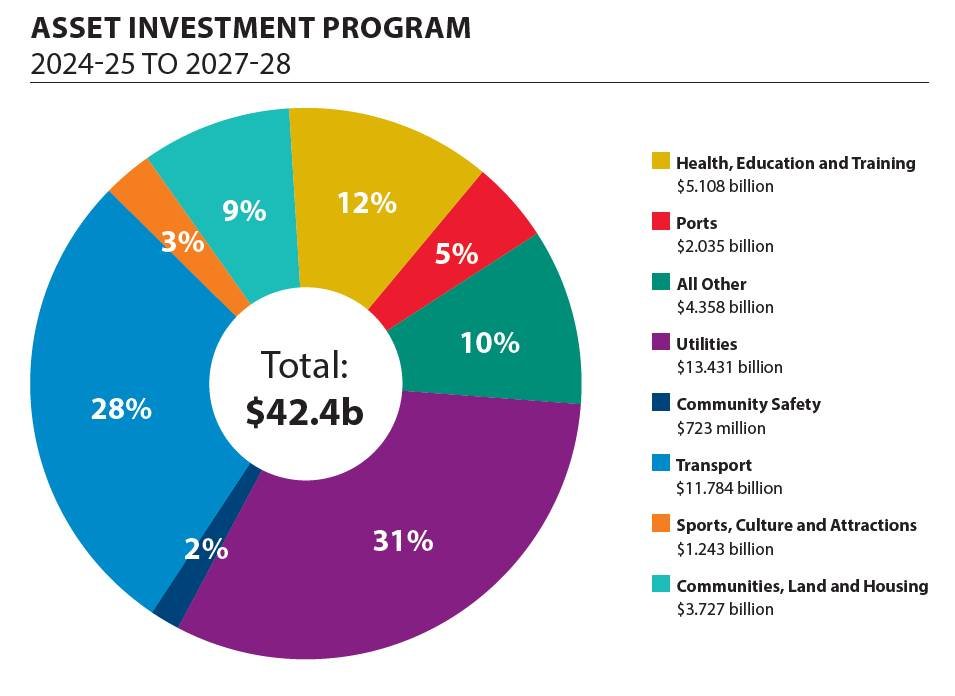

The 2024-25 budget outlined a record investment of $12.1 billion into the state’s asset investment program, and $42.2 billion over the out years to the end of the 2028 financial year.

Transport spending will account for 28 per cent of the latter figure, with utilities attracting a larger portion of the pie (31 per cent) as the government’s focus moves to the energy transition.

In presenting the budget, Ms Saffioti moved to allay fears of a further labour supply squeeze in a state challenged by record low unemployment.

“Our feedback already in areas such as reinforced steel, concrete, bulk earthworks – some of the key services required for many of our transport infrastructure projects – have now tailed off because we’re in the last stage of delivery,” Ms Saffioti said.

“Capacity is being opened up across a number of different fronts.”

Synergy will spend $1.2 billion to progress existing battery and wind projects in the coming financial year, primarily at its Collie big battery project.

The Water Corporation will spend close to $600 million on the Alkimos seawater desalination plant program of works.

The Department of Planning, Lands and Heritage will continue strategic planning and design works for the Women and Babies Hospital, the development of an Aboriginal Cultural Centre – which attracted a $50 million federal commitment – and the delivery of the WACA Ground improvement project.

Planning for the Westport project, slated for delivery in the latter part of the 2030s, is under way.

Western Power’s planned $1.3 billion infrastructure spend offers insight into a looming challenge facing the state.

The bulk of this investment will go towards work to upgrade the state’s electricity grid in preparation for an anticipated spike in electricity demand.

The need for this work is becoming increasingly clear.

An Infrastructure WA assessment of Western Power’s plans to upgrade transmission infrastructure in the northern part of the South West Interconnected System, released publicly in March, highlighted the task ahead.

In it, the independent body tasked with providing advice to the state government on infrastructure matters revealed that the Yandin and Warradarge wind farms in the Wheatbelt and Mid West regions, respectively, were not currently supplying the grid to capacity.

The constraint on the renewables projects is not in the projects themselves but rather the network infrastructure supporting them.

“These assets are currently operating in a constrained manner and below generation capacity due to the current transmission network capacity being largely utilised,” IWA said.

“Network upgrades are required to enable optimal operation of current and connection of additional generation.”

IWA flagged a challenge of a different kind, albeit with similar implications, in its assessment of Synergy battery projects at Kwinana and Collie published late last year.

That report, written before but published days after the announcement of Kwinana as the preferred site of the Westport development, warned of congestion risk in the industrial area that could cause delays to the construction program.

The Westport announcement came with a commitment to widen the Kwinana Freeway between Anketell and Russell roads, upgrade Roe Highway and extend Anketell Road.

In February, retiring Liberal Senator for Western Australia Linda Reynolds flagged concerns over supporting infrastructure for Rockingham as the shadow of a looming international defence presence in the region from 2027 grows larger.

The AUKUS agreement – a trilateral defence partnership between Australia, the UK and the US – is expected to bring nuclear submarines to WA for rotation as early as 2027.

In a Senate estimates hearing in February, Senator Reynolds flagged concerns that the Department of Defence had not yet put any AUKUSrelated infrastructure projects before the Department of Infrastructure, Transport, Regional Development, Communications and the Arts just two and a half years out from the prescribed AUKUS timeline.

A representative for the federal department confirmed that neither the delivery of a mooted Garden Island Highway nor the proposed duplication of a bridge to Garden Island were on her radar at the time and said their delivery in a two-year timeframe was “potentially optimistic”.

The federal government’s recent budget allocated $2.59 billion to AUKUS for the 2024-25 financial year, including funds for infrastructure provisions in South Australia and WA.

Responsibility for AUKUS-related infrastructure falls on the federal government.

Bringing the supporting infrastructure up to a level where it can facilitate the next generation of WA’s major public projects in time looms as a significant challenge facing government.

Switching on

Speaking at a Business News event mapping his company’s path back from voluntary administration under the ownership of Italian firm WeBuild, Clough managing director Peter Bennett identified the energy transition – and transmission – as a key opportunity for the sector.

Clough, which has key contracts at the Waitsia Stage Two gas project in the onshore Perth Basin and at Perdaman’s Ceres urea project under a joint venture with Saipem, has grown its focus in energy and energy-adjacent sectors in recent years.

“Power generation, power storage and power transmission are key; this journey to a carbon neutral world is one we’re keen on,” Mr Bennett said in May.

“We see a lot of investment in that space, and we’ve got a much larger focus on that.”

On the infrastructure front, energy, water, health and defence were identified as areas of potential growth.

Mr Bennett also spoke on the alliance contract model that returned to prominence in recent years, particularly on government tenders for major works, including those under the Metronet and Main Roads banners.

While the alliance model was not a new development in a cyclical sector, Mr Bennett said he expected the shared risk aspects of alliance contracting to persist in the years ahead.

“I do think that there’s going to be a more permanent shift to that more equitable risk sharing,” he said.

“I don’t think we’re ever going to see the supply chain market get back to the levels of stability that we have seen historically, and there is just risk in those processes, both for us and for our clients.

“We have the risk on the project performance and the client absolutely has the risk in their ability to start operations at the time that they’re meant to.

“I suspect that more equitable and integrated project delivery model is probably going to be the pathway for the future.”